property tax assistance program illinois

CAAs may partner with local governments community-based organizations and the private sector to provide services. Administration including the Emergency Mortgage and Rental Assistance Programs in 2020 and the Illinois Rental Payment Program in 2021.

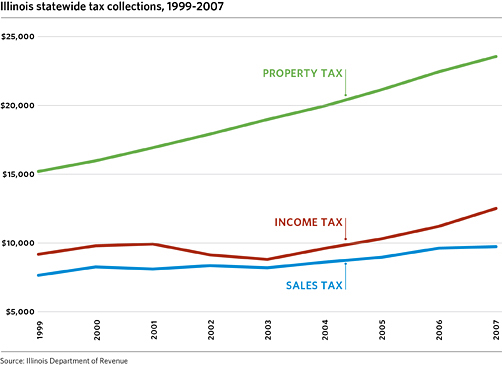

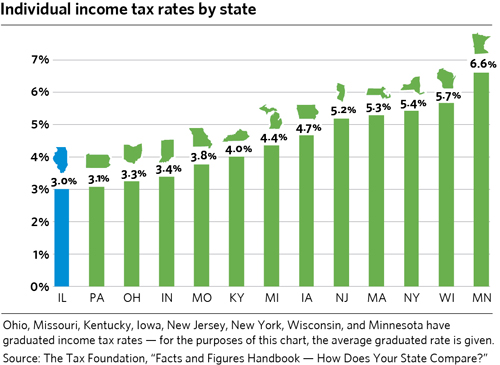

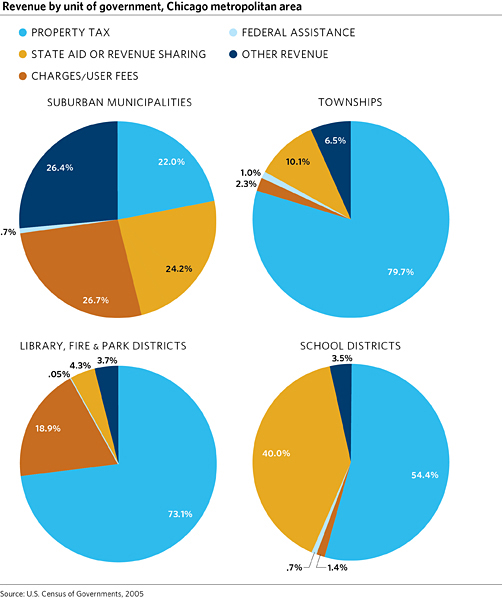

Dusting Off The Income Property Tax Swap Debate Cmap

For up to 30000 in free assistance to pay past due mortgage payments property taxes property insurance and delinquent homeowner andor condo association fees.

. The Illinois Rental Payment Program ILRPP provides financial assistance for rent to income-eligible Illinois renters and their landlords who have been impacted by the COVID-19 pandemic. Ad Homeowners Relief Program is Giving 3708 Back to HomeownersCheck Your Eligibility. 31 rows Part 530 - Senior Citizens Disabled Persons Property Tax ReliefPharmaceutical Assistance.

Illinois property tax bills are on their way and payment is due in June. If you are a renter in Illinois and are behind on rent due to COVID-19 you may be eligible for up to 25000 and 18 months of emergency rental payments. Up to 25 cash back Method 2.

The process to do this may vary but a good checklist can help you get on your way. Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today. With many families and businesses losing income due to the stay-at-home order amid.

That means 2018 property taxes on a home valued at 187200 the median in 2018 according to the Census Bureau could have topped 16000. Homeowners who are at least 30 days late on their mortgage or property tax payments. Wed 05132020 - 1200.

The COVID-19 vaccines are safe and effective and are an important tool for ending the global pandemic. If you think your homes latest assessment value is too high you can file an appeal that challenges your tax assessment. Property tax assistance program illinois Wednesday April 13 2022 Edit.

If you are a taxpayer and would like more information or forms please contact your local county officials. Dont Miss Your Chance. Beginning January 1 2001 legislation will take effect that may significantly increase the.

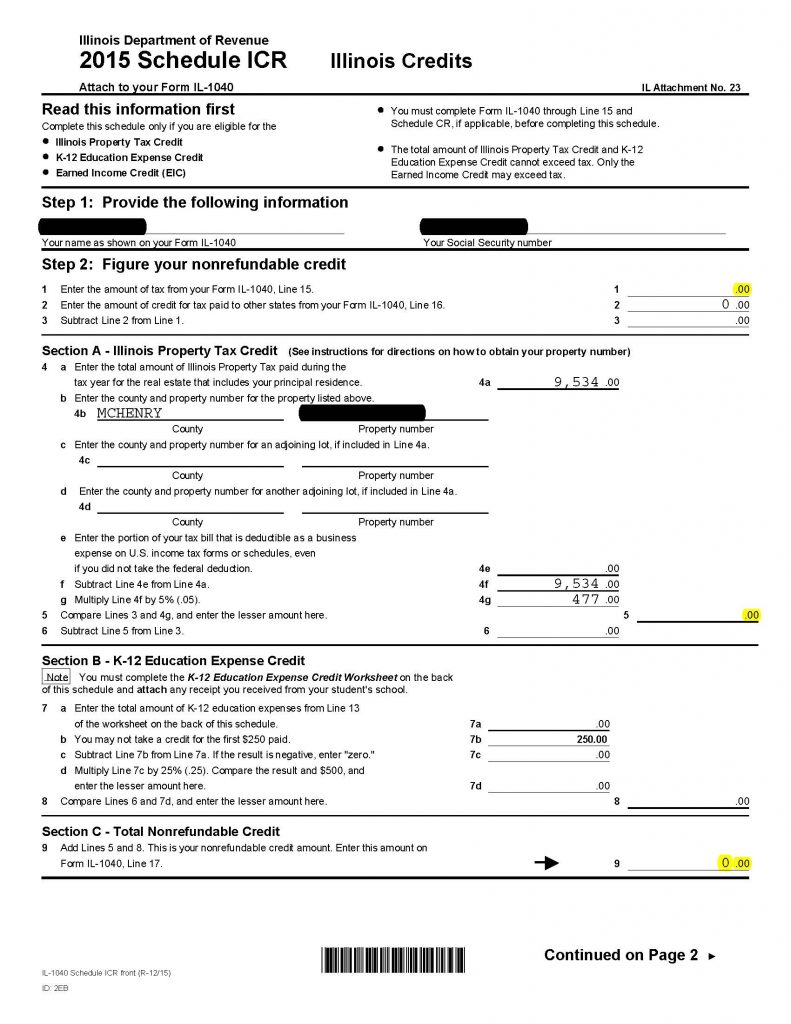

Beyond trying to lower the appraised value of your home in the eyes of the assessor Illinois also allows for reduced property taxes if you meet certain requirements. Pharmaceutical assistance to Illinois senior citizens. To see if you qualify give us a call today at 312-626-9701 or fill out the form below to have one of our representatives give you a call.

Cook County announces property tax relief for County property owners. The Illinois Homeowner Assistance Fund ILHAF is a federally funded program dedicated to assisting homeowners who are at risk of default foreclosure or displacement as result of a financial hardship caused by the COVID-19 pandemic. The National Taxpayers Union Foundation estimates that between 30 and 60 of taxable property in the US.

I hope this information helps you Find. If you apply and are qualified for this property tax. However please note that beginning FY 20 any recipient of the PTRG will need to file the abatement for 2 years.

Will my Property Tax Relief Grant PTRG be added to my Base Funding Minimum. Over 60 years old. This exemption limits EAV increases to a specific annual percentage increase that is based on the total household income of 100000 or less.

Senior Citizens Property Tax AssistanceSenior Freeze. We have funds available for delinquent taxes on a first come first served basis and assistance can only be given to one property per Illinois homeowner. Obtain All Tax Breaks to Which Youre Entitled.

A property tax freeze for seniors is a type of property tax reimbursement that will put a stop to the increase of your property tax bills. Mortgage Relief Program is Giving 3708 Back to Homeowners. Some programs allow the creation of property tax installment plans for property owner s who are delinquent in paying taxes as a result of saying being unemployed for the last several months.

Your household income from all sources for the prior year must be below 55000. The homeowner or homestead exemption allows you to take 10000 off of your EAV. You may be eligible to receive financial assistance for the following.

The 10000 reduction is the same for every home no matter its market value or EAV. The Property Tax Relief Grant PTRG is a one year grant program. The Illinois Rental Payment Program ILRPP provides financial assistance for rent to income-eligible Illinois renters and their landlords who have been impacted by the COVID-19 pandemicIf you are a renter in Illinois and are behind on rent due to COVID-19 you may be eligible for up to 25000 and 18 months of emergency rental payments.

Federal funding is provided to Illinois 36 Community Action Agencies to deliver locally designed programs and services for low-income individuals and families. Therefore the Circuit Breaker program alone cannot solve the. Any negotiated program will be effective after the local government officials have thoroughly reviewed the owners ability to pay and the request from.

The average total property tax rate in Illinois during the 2018 tax year was 859. The chief statewide programs in Illinois are summarized here. Ad 2022 Latest Homeowners Relief Program.

The property must be occupied for 10 continuous years or 5 continuous years if the person receives assistance to acquire the property as part of a government or non-profit housing program. The amount of tax relief is relatively minor. If a home has an EAV of 200000 its tax value would be 190000.

Ad Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today. Together these programs will deliver more. Search for jobs related to Property tax assistance program illinois or hire on the worlds largest freelancing marketplace with 21m jobs.

Own and occupy a property. This is a fairly large discount and can help people save a. 2 The amount of tax relief is relatively minor.

There may be some assistance available for delinquent property taxes in Winnebago County Illinois. It is managed by the local governments including cities counties and taxing districts. Fortunately the Land of Lincoln provides multiple property tax exemptions that may help reduce the burden of property.

Seniors with income of less than 45000 a year can expect rebate amounts ranging from 1 to 350. For the law itself see Illinoiss Property Tax Code at 35. General Information and Resources - Find information.

Recognizing the financial toll of the coronavirus and the pressing need to extend economic relief to area homeowners Cook County Board President Toni Preckwinkle announced Wednesday plans to waive late fees on property tax payments. Check If You Qualify For This Homeowner StimuIus Fast Easy. The Illinois Department of Revenue does not administer property tax.

27610 for a household of one. I recommend that you visit the Illinois Property Tax Appeal Board Taxpayer Assistance Web page to learn about what assistance may be available. The program is administered by the Illinois Housing Development Authority IHDA which will begin accepting applications from homeowners to eliminate or reduce past-due mortgage and property tax.

Its free to sign up and bid on jobs. The Circuit Breaker Property Tax Relief program provides rebates to qualified seniors for rent property taxes or nursing home charges. You may qualify for a senior freeze if you are.

Check Your Eligibility Today. Vaccines protect you and. Check If You Qualify For 3708 StimuIus Check.

Districts must apply annually if they wish to be considered for the future grant cycles. 1972 1998 - A progressive increase of the income ceiling is established from 10000 1972 to 16000 1998 per household. So if a propertys EAV is 50000 its tax value would be 40000.

1972 The Property Tax Relief Program is created. The Karpfs pay 10000 a year in property taxes.

Older Illinoisans Have More Options For Property Tax Relief Under Murphy Law

Pritzker Illinois Democrats Budget Agreement Provides 1 83 Billion In Tax Relief For Working Families Governor Says Cbs Chicago

Dusting Off The Income Property Tax Swap Debate Cmap

Cook County Property Tax Bill How To Read Kensington Chicago

Cook County Treasurer S Office Chicago Illinois

Democrats Reach Deal On 1 8 Billion In Tax Breaks With Direct Checks To Most Illinoisans

Covid 19 Faq Cook County Assessor S Office

Providing Some Property Tax Relief For Low Income Seniors

Pritzker To Propose Grocery Motor Fuel And Property Tax Relief For Illinoisans Stlpr

Governor Pritzker Presents 2023 Budget Including Property Tax Rebates Chicago Association Of Realtors

Dusting Off The Income Property Tax Swap Debate Cmap

/cloudfront-us-east-1.images.arcpublishing.com/gray/5YXGOVD3UZBEHAR3XJMAVLM7NI.PNG)

Gov Pritzker Signs Legislation Providing Property Tax Relief For Seniors Veterans Disabled Persons

Tax Lien Registry Tax Lien Registry

Statement From Assessor Fritz Kaegi On The Illinois Property Tax Credit Increase Cook County Assessor S Office

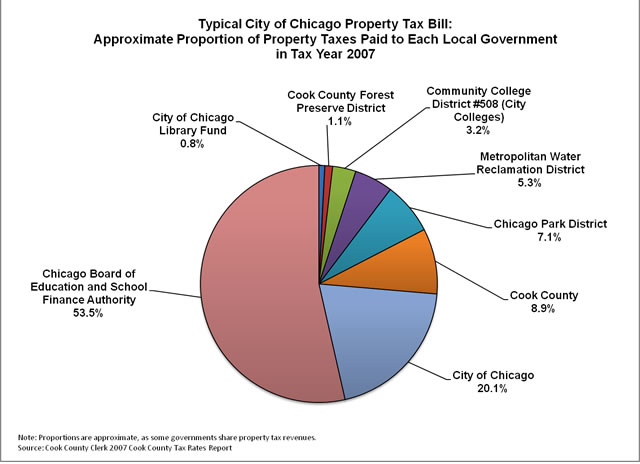

Where Do Your Property Tax Dollars Go The Civic Federation

Illinois Senate Democrats Propose 1b Tax Relief Plan Chicago News Wttw

Illinois Property Tax Exemptions What S Available Credit Karma Tax